Department of Health and Human Services

DEPARTMENTAL APPEALS BOARD

Civil Remedies Division

Sarah D. Carpenter,

Petitioner,

v.

U.S. Department of Health and Human Services,

Respondent.

Docket No. C-23-5

Decision No. CR6196

DECISION

Petitioner, Sarah D. Carpenter, was indebted to the United States in the amount of $13,307.47, plus any interest, penalties, and costs as authorized by 45 C.F.R. §§ 30.18 and 33.13. 1 The debt was subject to collection by administrative offset, administrative wage garnishment, or by other lawful means. However, Petitioner has informed me that the debt has been paid. 2

I. Procedural History

The Defense Finance and Accounting Service (DFAS) is the pay agent for the U.S. Department of Health & Human Services (HHS). Office of Medicare Hearings and Appeals Exhibit (OMHA Ex.) 11 at 1. DFAS sent Petitioner a letter dated August 27, 2022. DFAS informed Petitioner that it had determined that Petitioner was overpaid the gross amount of $19,171.08, including pay, taxes, benefits, and deductions or allowances, for pay periods ending February 12 through June 4, 2022, due to time and attendance.

Page 2

DFAS further informed Petitioner that it had adjusted the alleged debt amount to include offsets (refundable portions of taxes, benefits, and other deductions included in the calculation of the gross amount of the debt) and that the outstanding amount of the debt owed was $11,944.02. Departmental Appeals Board Electronic Filing System (DAB E-File) # 1 at 5 (document page counter).

DFAS sent Petitioner a second letter dated August 27, 2022. DFAS advised Petitioner that it determined that Petitioner was overpaid the gross amount of $1,426.20, including pay, taxes, benefits, and other deductions, during the pay period that ended March 13, 2021, due to time and attendance. DFAS informed Petitioner that it adjusted the gross amount and the net amount Petitioner owed was $1,363.45, after applying offsets including refundable portions of taxes, benefits, and other deductions included in the gross debt amount. DAB E-File # 1 at 10 (document page counter).

On September 26, 2022, Petitioner signed a request for hearing (RFH) that was received by “Human Resources” on September 27, 2022. Petitioner completed the RFH form to indicate that she3 disputed the existence of the debt and/or the amount owed to HHS or the repayment schedule proposed by HHS. Petitioner also stated in the RFH form that she received the debt letters on August 30, 2022. DAB E-File # 1 at 3-4 (document page counter). There is no assertion by HHS that Petitioner’s RFH was not timely filed.4 Petitioner also provided a memorandum as part of her RFH in which she explains her bases for challenging the debt. DAB E-File # 1 at 1-2.

Petitioner’s RFH was received at the Civil Remedies Division, Departmental Appeals Board on October 3, 2022. DAB E-File # 1m at 1 (document page counter). The case

Page 3

was docketed and assigned to me on October 4, 2022, and I issued an “Acknowledgment of Request for Hearing and Order for Case Development” (Prehearing Order).

On October 31, 2022, HHS filed a brief (HHS Br.) with exhibits 1 through 11,5 and Petitioner filed a brief (P. Br.) with Petitioner’s exhibits (P. Exs.) 1 through 5. On November 1, 2022, I issued an order authorizing the parties to file reply briefs and any additional evidence, or a waiver of reply, no later than November 14, 2022. HHS filed a reply brief on November 14, 2022 (HHS Reply). Petitioner filed a reply brief on November 28, 2022 (P. Reply), after being granted an extension of time to do so. Petitioner filed two attachments with her reply which are not marked as exhibits, but I treat them as if marked P. Ex. 6 and P. Ex. 7. The offered exhibits are all considered as evidence.

II. Facts

The relevant facts are not disputed. The documentary evidence is credible. There are no issues of credibility or veracity that need to be resolved at an oral hearing.

Petitioner is an administrative law judge (ALJ) assigned to OMHA, in Phoenix, Arizona. Petitioner is also a Judge Advocate in the Washington State Air National Guard with the rank of Colonel. RFH at 1; P. Br. at 2; P. Ex. 3; OMHA Ex. 2.

Pursuant to an order issued by the Washington Air National Guard dated March 11, 2021, Petitioner was ordered to full-time National Guard Duty for annual training under 32 U.S.C. § 502(a), for the period March 1 through 5, 2021. The order specifies Petitioner was to telecommute. OMHA Ex. 6 at 1.

Pursuant to an order issued by the Washington Air National Guard also dated March 11, 2021, Petitioner was ordered to perform duties with Headquarters, Washington Air National Guard as a Judge Advocate for the period March 8 through 12, 2021. The orders specify that she was to “telecommute.” The training duty is listed as “annual training.” The order states that the period of service was ordered under 32 U.S.C. § 502(a).6 P. Ex. 4 at 1; OMHA Ex. 6 at 4.

Page 4

Pursuant to an order issued by the Department of the Air Force National Guard Bureau dated February 2, 2022, Petitioner was ordered to perform duties with the National Guard Bureau General Counsel for the period February 7 through February 18, 2022. The orders reflect that Petitioner would be telecommuting to perform the duty. The order states that the period of service was ordered under 10 U.S.C. § 12301(d).7 P. Ex. 4 at 2; OMHA Ex. 6 at 6-7.

Page 5

Pursuant to an order issued by the Washington Air National Guard dated March 2, 2022, Petitioner was ordered to perform duty with the National Guard Bureau General Counsel for the period February 28 through March 11, 2022. The order specified that the type of duty was full-time National Guard Duty for annual training under 32 U.S.C. § 502(a). The order indicates that Petitioner would telecommute to perform the duty. P. Ex. 4 at 3; OMHA Ex. 6 at 9-10.

Pursuant to an order issued by the Department of the Air Force National Guard Bureau dated June 1, 2022, Petitioner was ordered to perform duty with the 62nd Airlift Wing Office of the Staff Judge Advocate for the period April 4 through June 30, 2022. The order specified that the type of duty was voluntary active duty under 10 U.S.C. § 12301(d). P. Ex. 4 at 4; OMHA Ex. 6 at 12-13.

Therefore, the evidence shows, and Petitioner does not dispute, that she was ordered to perform military duties on the following dates:

March 1 through 5, 2021,

March 8 through 12, 2021,

February 7 through 18, 2022,

February 28 through March 11, 2022, and

April 4 through June 30, 2022.

Petitioner does not dispute that she performed duty for the National Guard on the dates ordered. RFH; P. Br.; P. Reply. The evidence includes certifications (Statement of Duty) by Petitioner that indicate that Petitioner was on duty continuously 24 hours per day during three of the periods:

Reported for duty at 7:00 a.m. on March 1, 2021, and was released from duty at 4:00 p.m. on March 5, 2021;

Reported for duty at 7:00 a.m. on February 7, 2022, and was released from duty at 4:00 p.m. on February 18, 2022;

Reported for duty at 7:00 a.m. on February 28, 2022, and was released from duty at 4:00 p.m. on March 11, 2022; and

Reported for duty at 7:00 a.m. on April 4, 2022, but no released hour and date are indicated.

OMHA Ex. 6 at 3, 8, 11, 14. There is no certification in evidence related to the period March 8 through 12, 2021.

Page 6

The periods Petitioner performed duty for the National Guard fell within the following civilian pay periods:

| CALENDAR YEAR | PAY PERIODS | NATIONAL GUARD SERVICE |

|---|---|---|

| 2021 | 6 | March 1 through 5, 2021 |

| 2021 | 6 | March 8 through 12, 2021 |

| 2022 | 4, 5 | February 7 through 18, 2022 |

| 2022 | 6 | February 28 through March 11, 2022 |

| 2022 | 8-14 | April 4 through June 30, 2022 |

OMHA Ex. 3.

Petitioner executed a telecommuting agreement with her Washington National Guard supervisor dated May 4, 2019. P. Exs. 2, 5. She was issued a laptop computer and cell phone by the Washington National Guard to perform telecommuting. P. Ex. 5 at 5.

Petitioner’s first-line supervisor at OMHA states that Petitioner had preapproval from HHS to perform regular duty part-time for HHS while she was serving “on flexible telework orders as a Guardsman.” He states Petitioner worked part-time for HHS for several months while she performed telework for the National Guard. P. Ex. 1.

The Integrated Time and Attendance System (ITAS) is HHS’ and OMHA’s timekeeping system in which an employee’s time and attendance are recorded. OMHA Ex. 11 at 1 ¶ 2.

On May 2, 2022, Petitioner requested by email to use leave without pay (LWOP) rather than annual leave while serving on military duty. In her email request, Petitioner noted that the Office of Personnel Management (OPM) instructs agencies to document an employee’s use of LWOP for uniformed services (LWOP-US) with a personnel action using Standard Form (SF) 50. OMHA Ex. 4 at 4-5. The email thread among staff indicates that Petitioner wanted to work four hours in the morning for OMHA and receive regular pay and then she wanted to take LWOP for the remainder of the civilian workday at OMHA, during which period she performed military duty. OMHA Ex. 4 at 1-2, 4. One OMHA staff member pointed out in the email thread on May 5, 2022, that if Petitioner was placed in a LWOP-US status using an SF50, DFAS would reject and not pay for any regular hours reported by Petitioner. Petitioner is not listed as an addressee on that email, and it is not clear that she was informed of the possible problem with her proposed course of action. OMHA Ex. 4 at 1. The same OMHA staff member also informed other staff on May 5, 2022, that employees on military orders cannot work their normal position while on military orders according to a ruling of the Comptroller General. The email was not clear as to whether the staff member was referring to the

Page 7

entire workday or some part of the workday. Petitioner is also not listed as an addressee on that email, and it is not clear that she was informed of the possible problem. OMHA Ex. 4 at 2-3.

OMHA Ex. 8 is a compilation of information in tabular format from Petitioner’s military orders (OMHA Ex. 6) and her master time histories (OMHA Ex. 7). OMHA Ex. 11 at 3-4 ¶¶ 12-15. The tables show the change of the original pay code reported by Petitioner for each day from regular or holiday hours to LWOP and the total hours for which Petitioner was overpaid by pay period. Jayson Watkins, Branch Chief of the Employee Benefits and Payroll Branch, OMHA, oversaw the adjustments made to Petitioner’s pay account (timecards) that resulted in the overpayment. OMHA Ex. 11 at 1 ¶ 3. The changes were made by “Customer Care Services,” OMHA’s liaison to the Defense Civilian Pay System (DCPS). DFAS issues payments for HHS employees based on leave and earnings calculated by DCPS. OMHA Ex. 11 at 1 ¶ 2.

OMHA Ex. 8 reflects the changes made to Petitioner’s time and attendance records that resulted in the debt. During pay period (PP) 6, 2021, Petitioner reported 20 hours as regular hours in ITAS for which she was paid, hours that were changed to LWOP for which she should not have been paid. OMHA Ex. 8 at 1. During PP 4, 2022, Petitioner reported 10 hours as regular hours in ITAS for which she was paid, but those hours should have been reported as LWOP, for which she should not have been paid. OMHA Ex. 8 at 2. During PP 5, 2022, Petitioner reported 10 hours as regular hours for which she was paid, that were changed to LWOP for which she should not have been paid. OMHA Ex. 8 at 3. During PP 6, 2022, Petitioner reported 40 hours as regular hours for which she was paid, that were changed to LWOP for which she should not have been paid. OMHA Ex. 8 at 4. During PP 8, 2022, Petitioner reported 36 hours as regular hours for which she was paid, that were changed to LWOP for which she should not have been paid. OMHA Ex. 8 at 6. During PP 9, 2022, Petitioner reported 40 hours as regular hours in ITAS for which she was paid, that were changed to LWOP for which she should not have been paid. OMHA Ex. 8 at 7. In PP 10, 2022, Petitioner reported 40 hours as regular hours for which she was paid, that were changed to LWOP for which she should not have been paid. OMHA Ex. 8 at 8. During PP 11, 2022, Petitioner reported 40 regular hours for which she was paid, that were changed to LWOP for which she should not have been paid. OMHA Ex. 8 at 9. During PP 12, 2022, Petitioner reported 20 regular hours and 8 holiday hours for which she was paid, that were changed to LWOP for which she should not have been paid. OMHA Ex. 8 at 10. OMHA Ex. 8 also shows that on 25 days Petitioner reported in ITAS that she worked 4 regular hours and took 4 hours annual leave to perform active duty; on 21 days Petitioner reported in ITAS that she worked 4 regular hours and claimed 4 hours of military leave; and on 16 days Petitioner reported in ITAS that she worked 2 regular hours and claimed 6 hours of military leave. On April 20, 2022, Petitioner claimed that she was sick for 4 hours and worked 4 regular hours, but that is a day she had orders for military duty. OMHA Ex. 8 at 7; OMHA Ex. 6 at 12; P. Ex. 4 at 4. On April 25, 2022, Petitioner reported 4 hours as

Page 8

LWOP and that she worked 4 regular hours. OMHA Ex. 8 at 10. Petitioner disputes that she could not be paid for work performed on the same days for the military and OMHA. She does not dispute the calculations of the number of hours that she was overpaid by HHS.

The following table summarizes the hours Petitioner was overpaid by pay period.

| CALENDAR YEAR | PAY PERIODS (PP) | NATIONAL GUARD SERVICE | HOURS OVERPAID |

|---|---|---|---|

| 2021 | 6

|

March 1 through 5, 2021 March 8 through 12, 2021 |

20 |

| 2022 | 4, 5 | February 7 through 18, 2022 | 10 (PP 4) 10 (PP 5) |

| 2022 | 6

|

February 28 through March 11, 2022 | 40 |

| 2022 | 8-14 | April 4 through June 30, 2022 | 36 (PP 8) 40 (PP 9) 40 (PP 10) 40 (PP 11) 28 (PP 12)

|

HHS provided no worksheets for pay periods 13 and 14 in 2022. Therefore, I infer that there are no hours for which Petitioner was overpaid after June 4, 2022, the end of pay period 12 in 2022. OMHA Ex. 3 at 2; HHS Br. at 3. The worksheets reflect that Petitioner was overpaid a total of 264 hours.

Petitioner’s hourly rate of pay in calendar year (CY) 2021 was $71.31. DAB E-File # 1l at 2; OMHA Ex. 9 at 2. Her hourly rate in CY 2022 is $78.57. DAB E-File ## 1c-k. Calculation of the gross overpayment is not complicated.

Page 9

| CY | HOURS OVERPAID | HOURLY RATE | GROSS AMOUNT OVERPAID | ||

|---|---|---|---|---|---|

| 2021 | 20 | x | $71.31 | = | $1,426.20 |

| 2022 | 244 | x | $78.57 | = | $19,171.08 |

| GROSS OVERPAYMENT | $20,597.28 | ||||

OMHA Exs. 8; 10 at 1-2; 11 at 4.

OMHA Ex. 10 includes worksheets used by DFAS to calculate Petitioner’s debt. According to the worksheets, Petitioner’s total gross debt was $20,597.28. However, recovery of federal and state taxes and withholding are deducted from the gross debt yielding a net debt outstanding of $13,307.47 ($1,363.45 CY 2021 and $11,944.02 CY 2022). OMHA Exs. 10 at 1-2, 15-18; 11 at 5.

Petitioner represents in her brief that she has paid the debt and I accept that representation as true. P. Br. at 3.

III. Issues

Whether Petitioner is indebted to the government; and

Whether the amount of Petitioner’s indebtedness to the government is $13,307.47, or some greater or lesser amount.

IV. Conclusions of Law and Analysis

1. A member of a Reserve component of one of the armed forces or the National Guard or the National Guard of the United States, when in active-duty status in a uniformed service (including full-time National Guard duty), may not receive pay as a federal employee in the civil service of the United States.

2. Receipt of pay from a civil service position while receiving pay for active duty with the armed forces (including full-time National Guard duty) is prohibited, except during a period of terminal leave or authorized military leave.

3. Petitioner, a member of the Washington Air Force National Guard and the Air Force National Guard of the United States, while in an active-duty status, received pay and allowances from HHS as an employee in the civil service of the United States.

Page 10

4. Petitioner is indebted to the government for pay received from HHS during periods of active duty, including full-time National Guard duty.

5. Petitioner is indebted to the United States in the amount of $13,307.47.

Civil Service and Active Duty in the Armed Forces

Pursuant to 5 U.S.C. § 2101, the civil service of the United States includes all appointive positions in the executive, judicial, and legislative branches of the federal government except positions in the uniformed services. An “employee” of the federal government is: (i) an officer8 of the United States or an individual appointed in the civil service by one with authority to do so; (ii) is engaged in the performance of a federal function under authority of law or Executive act; and (iii) is subject to supervision of the appointing authority while engaged in the performance of the duties of their position. 5 U.S.C. § 2105(a). Thus, a member of a uniformed service is not a federal employee within the meaning of the statutes. Congress has specified that “[a] Reserve of the armed forces who is not on active duty or who is on active duty for training is deemed not an employee or an individual holding an office of trust or profit or discharging an official function under or in connection with the United States because of his appointment, oath, or status, or any duties or functions performed or pay or allowances received in that capacity.” 5 U.S.C. § 2105(d). The legislative history of this provision indicates that Congress intended to protect Reservists against the application of dual compensation and employment laws that might be applied to deny them participation in the Reserve components. S. Rep. No. 82-1795, Chap. V., § 241 (1952), reprinted in 1952 U.S.C.C.A.N. 205.

Page 11

ALJs are appointed to the civil service pursuant to 5 U.S.C. § 3105, which provides, in part, that “[e]ach agency shall appoint as many administrative law judges as are necessary for proceedings required to be conducted in accordance with [5 U.S.C. §§ 556 and 557 (Administrative Procedure Act of 1946)].” ALJs are federal officers or employees within the meaning of 5 U.S.C. § 2105(a). ALJ pay is determined in accordance with 5 U.S.C. § 5372(b). Congress tasked the Office of Personnel Management (OPM) with promulgating regulations governing the appointment and pay of ALJs. 5 U.S.C. § 5372(c); 5 C.F.R. pt. 930, subpt. B (2019).

Civil Service and Military Pay

The basic administrative workweek for a full-time federal employee in the civil service is 40 hours performed within not more than six of seven consecutive days. 5 U.S.C. § 6101(a)(2). Flexible and compressed work-schedules are permitted. 5 U.S.C. §§ 6122, 6127. A pay period for a federal employee, including ALJs, is two administrative workweeks of 80 hours total. 5 U.S.C. § 5504. A federal employee is entitled to pay for the hours worked, for holidays, or in an authorized leave status (5 U.S.C. §§ 6104, 6301-6328), but not for periods of absence without leave or LWOP. 5 U.S.C. § 6104. A federal employee who is also a member of a Reserve component (10 U.S.C. § 10101) or the National Guard (32 U.S.C. § 101), such as Petitioner, “is entitled to leave without loss in pay, time, or performance or efficiency rating for active duty, inactive-duty training, . . . funeral honors duty, . . . as a Reserve of the armed forces or member of the National Guard.” 5 U.S.C. § 6323(a). Military leave “accrues . . . at the rate of 15 days per fiscal year and, to the extent that it is not used in a fiscal year, accumulates for use in the succeeding fiscal year until it totals 15 days at the beginning of a fiscal year.” 5 U.S.C. § 6323(a)(1). The minimum charge to military leave is one hour and multiples thereof. 5 U.S.C. § 6323(a)(3). An employee may also request to use annual leave or compensatory time to which they are otherwise entitled, but not sick leave, in lieu of or in addition to military leave. 5 U.S.C. § 6323(b)(2), (d)(2); 5 C.F.R. § 353.208.

Members of the uniformed services are paid monthly. 37 U.S.C. § 203(a). A member of a uniformed service who is entitled to pay for a period of less than 30 days is paid 1/30 of the monthly amount for each day the individual is entitled to pay. 37 U.S.C. § 1004. The Comptroller General explained in Matter of: Public Health Service Officer, B-214919, 64 Comp. Gen. 395 at 400 (1985 WL 50669) (emphasis added), that members of the uniformed services are entitled to pay based upon their status as members − not upon the number of hours of work performed − they are in status 24 hours a day even though they may be scheduled to work only certain hours in a 24-hour period.

Active Duty and Full-time National Guard Duty

The military departments are the Departments of the Army, Navy, and Air Force. 5 U.S.C. § 102. The armed forces are the Army, Navy, Air Force, Marine Corps, Space

Page 12

Force, and the Coast Guard. 5 U.S.C. § 2101(2); 10 U.S.C. § 101(a)(4); 32 U.S.C. § 101(2). The uniformed services include the armed forces, the commissioned corps of the Public Health Service, and the commissioned corps of the National Oceanic and Atmospheric Administration. 5 U.S.C. § 2101(3). Military refers to the Army, Navy (including the Marine Corps and Coast Guard), and the Air Force (including the Space Force). Military personnel include commissioned officers, warrant officers, and enlisted members. 10 U.S.C. § 101(a)(8), (b).

The reserve components of the armed forces are the Army National Guard of the United States, the Army Reserve, the Navy Reserve, the Marine Corps Reserve, the Air National Guard of the United States, the Air Force Reserve, and the Coast Guard Reserve. 10 U.S.C. § 10101.

The terms “Army National Guard” and “Air National Guard” refer to the organized militia of each state. 10 U.S.C. § 101(c)(1), (2), (4); 32 U.S.C. § 101(3), (4), (6). The Army National Guard of the United States and the Air Force National Guard of the United States, refer to members of reserve components all of whom are members of the state Army and Air Force National Guards. 10 U.S.C. § 101(c)(3), (5); 32 U.S.C. § 101(5), (7).

Statutory authority related to the National Guard is found in Title 32 U.S.C., while statutory authorities related to federal military forces are found in Title 10 U.S.C.

There is no factual dispute that throughout the period when the debt arose, Petitioner was a Reserve commissioned officer in the Air National Guard of Washington (P. Ex. 3) and, therefore, in the Air National Guard of the United States. Petitioner was ordered to perform military duties March 1 through 5, 2021; March 8 through 12, 2021; and February 28 through March 11, 2022, pursuant to 32 U.S.C. § 502(a). Under 32 U.S.C § 502(a), Petitioner performed military duty as a member of the Washington Air National Guard. Petitioner was ordered to perform military duties February 7 through 18, 2022 and April 4 through June 30, 2022, pursuant to 10 U.S.C. § 12301(d). Under 10 U.S.C. § 12301(d), Petitioner performed military duties as a member of the Air National Guard of the United States. P. Ex. 3. There is also no dispute that Petitioner was in the civil service as an ALJ assigned to HHS, OMHA, during the periods covered by her orders.

There are conflicting definitions of “active duty” in the statutes that must be reconciled in this case.

The pay and allowances of the uniformed services of the United States are controlled under Title 37 U.S.C. Under 37 U.S.C. § 101(18):

The term “active duty” means full-time duty in the active service of a uniformed service, and includes full-time training

Page 13

duty, annual training duty, full-time National Guard duty, and attendance, while in the active service, at a school designated as a service school by law or by the Secretary concerned.

37 U.S.C. § 101(18) (emphasis added).

Title 10 U.S.C. establishes the Army, Navy, Marine Corps, Air Force, Space Force, and the Reserve Components. Under 10 U.S.C. § 101(d)(1):

The term “active duty” means full-time duty in the active military service of the United States. Such term includes full-time training duty, annual training duty, and attendance, while in the active military service, at a school designated as a service school by law or by the Secretary of the military department concerned. Such term does not include full-time National Guard duty.

10 U.S.C. § 101(d)(1) (emphasis added).

The different definitions of active duty reflect the different focus of Title 10 and Title 37 U.S.C. Full-time National Guard duty is excepted from the definition of active duty in 10 U.S.C. § 101(d)(1) and a separate definition of “full-time National Guard duty” is provided. Full-time National Guard duty is defined as training or other duty performed by a member of the Army or Air National Guards of the United States in their status as members of the National Guard of the state or territory, the Commonwealth of Puerto Rico, or the District of Columbia when duty is ordered under 32 U.S.C. §§ 316, 502, 503, 504, or 505, for which the member receives pay from the United States or waives pay from the United States. 10 U.S.C. § 101(d)(5). Active service is defined as service on “active duty or full-time National Guard duty.” 10 U.S.C. § 101(d)(3). Title 32 U.S.C. provides authority for federal use of the Army or Air National Guards of the states or territories, the Commonwealth of Puerto Rico, or the District of Columbia as part of the Army National Guard of the United States and the Air National Guard of the United States. Under Title 32, “active duty” also excludes full-time National Guard duty (32 U.S.C. § 101(12)) and full-time National Guard duty is defined similarly to the definition in 10 U.S.C. § 101(d)(5). 32 U.S.C. § 101(19). However, under Title 37 U.S.C., for purposes of determining entitlement to pay and allowances, the term “active duty” includes full-time National Guard duty. 37 U.S.C. § 101(18). Analysis for the reasons for the varying definitions is not important for this decision. What is important is recognizing that for purposes of military pay “active duty” includes full-time National Guard duty.

Pursuant to 32 U.S.C. § 101(19):

Page 14

‘‘Full-time National Guard duty’’ means training or other duty, other than inactive duty, performed by a member of the Army National Guard of the United States or the Air National Guard of the United States in the member’s status as a member of the National Guard of a State or territory, the Commonwealth of Puerto Rico, or the District of Columbia under section 316, 502, 503, 504, or 505 of this title for which the member is entitled to pay from the United States or for which the member has waived pay from the United States.

I conclude that 37 U.S.C. § 101(18) provides the controlling definition of “active duty” in matters relating to military pay. Petitioner’s orders all indicate that she was to perform full-time National Guard duty or active duty. OMHA Ex. 6 at 1, 4, 6, 9, 12; P. Ex. 4 at 1-4. In fact, the certifications of performance of duty (Statements of Duty) in evidence support the inference that Petitioner was in active-duty status (including full-time National Guard) for 24 hours per day during the periods she was ordered to such status. The certifications indicate Petitioner was on duty continuously 24 hours per day, even if she may have performed military duties for less than the full day, during at least three of the periods of active duty (including full-time National Guard duty):

Reported for duty at 7:00 a.m. on March 1, 2021, and was released from duty at 4:00 p.m. on March 5, 2021;

Reported for duty at 7:00 a.m. on February 7, 2022, and was released from duty at 4:00 p.m. on February 18, 2022; and

Reported for duty at 7:00 a.m. on February 28, 2022, and was released from duty at 4:00 p.m. on March 11, 2022.

OMHA Ex. 6 at 3, 8, 11, 14. I conclude that the periods of military duty Petitioner was ordered to perform under 10 U.S.C. § 12301(d) and 32 U.S.C. § 502(a) were “active duty,” which under 37 U.S.C. § 101(18) includes full-time National Guard duty.

Petitioner argues that she was not serving regular active duty but was serving on telework orders on a flexible schedule. RFH at 1; P. Br. at 1; P. Reply at 3. However, Petitioner cites no statutory or regulatory authority, and I can locate no provision in Titles 10, 32, or 37, that suggest that telework on a flexible schedule is not active duty (including full-time National Guard duty).

Page 15

Dual Pay and the Incompatibility Doctrine

Petitioner argues that receipt of dual pay by Reserves and National Guard members is not prohibited. She cites 5 U.S.C. § 5534, which provides:

A Reserve of the armed forces or member of the National Guard may accept a civilian office or position under the Government of the United States or the government of the District of Columbia, and he is entitled to receive the pay of that office or position in addition to pay and allowances as a Reserve or member of the National Guard.

The debt in this case was not declared by HHS and DFAS in violation of 5 U.S.C. § 5534. Rather, the debt arose because Petitioner violated a longstanding, often stated, and well recognized interpretation of federal law that receipt of pay and allowances for a civil service position or contract paid by appropriated funds by one on active duty in the uniformed services is prohibited. In this case, HHS refers to the incompatibility principle, i.e., active military service is incompatible with rendering services to the federal government in another position or employment, absent a specific statutory authorization. HHS Br. at 6-8, HHS Reply at 4. I prefer the “incompatibility doctrine” given its long history and repeated and consistent acceptance and application by the Comptroller General. Petitioner’s argument that she is entitled to receive both civilian pay for performance of work as an ALJ and military pay for the same periods is not unique and has been addressed and rejected many times. The following Comptroller General decisions squarely address the issues.

In 1938, the Comptroller General9 advised Acting Comptroller General Elliot to the Secretary of War, that an enlisted soldier could not be compensated for services to the

Page 16

Weather Bureau as an airway observer. After examining a prior Attorney General Opinion, Comptroller General Decisions, court decisions, and statutes, the Comptroller General concluded that “any appointment in the civil branch of the government would be incompatible with service on the active list of the Army.” Acting Comptroller General Elliott to The Secretary of War, A-51624, 18 Comp. Gen. 213, 216 (1938 WL 848) (Sept. 1, 1938). The Comptroller General reasoned that whether a soldier might have time to do both jobs is not the issue; rather, the obligation to render military service makes it impossible to accept, without qualification, an obligation to serve the government in a civilian capacity. Id. at 216-17. Petitioner’s argument that she was permitted to perform her active duty, including full-time National Guard duty using telework on a flexible schedule (P. Br. at 1), is therefore irrelevant. The Comptroller General was clear that whether a member of a uniformed service may have time to do both their military and civilian duties is simply not the issue.

In 1966, the Comptroller General wrote to the Secretary of Defense that officers and enlisted personnel serving extended active duty may not be employed during off-hours in civilian positions paid by appropriated funds, such as in the commissary and fire department on the military installation. The Comptroller General stated that it had been consistently held that a person in active military service could not be paid from appropriated funds for a civilian position absent a statute expressly permitting the payment. The Comptroller General noted that the Dual Compensation Act of 1964, Pub. L. 88-448, 78 Stat. 493 (Aug. 19, 1964) repealed certain statutory prohibitions on receipt of double salaries. The Comptroller General further noted that 5 U.S.C. § 5533, a codification of section 301 of the Dual Compensation Act, limited civilian compensation to not more than 40 hours in one calendar week in the case of civilian personnel serving in more than one civilian position. However, the Comptroller General pointed out that regardless of changes in the statutes, it had been repeatedly held by his office that holding a federal civilian position while receiving active duty pay as a member of the armed forces is prohibited as being incompatible with military service. The Comptroller General explained that the legislative history of the Dual Compensation Act made no reference to the issue of whether a person in active military service could be employed in

Page 17

a federal civilian position and be paid for that service with appropriated funds, despite the fact that the Act had been under consideration for several years and that the accounting officers of the government had issued numerous decisions that federal civilian employment was incompatible with military service. The Comptroller General reasoned that while Congress specifically enacted limitations on retired military members’ acceptance of civil service positions, Congressional silence was tacit approval of the rule that holding a civil service position was incompatible with active military service. Comptroller General to the Secretary of Defense, B-133972, 46 Comp. Gen. 400, 401-03 (1966 WL 1684) (Nov. 14, 1966). Petitioner argues in her defense that her receipt of dual compensation for her work as an ALJ and a member of the National Guard is permitted by the Dual Compensation Act. RFH at 1; P. Br. at 1. However, as the Comptroller General’s analysis shows, adoption of the Dual Compensation Act was not intended by Congress to have any impact on the incompatibility doctrine.

In 1978, the Comptroller General held that Army Reserve Officers, who were involuntarily separated from active duty but were subsequently restored to active duty by correction of their military records to show a continuous period of active duty, were indebted to the government for any civil service pay received during the period prior to their restoration to duty. In the Matter of Reserve Members Restored to Duty, B-190375, 57 Comp. Gen. 554 (1978 WL 13437) (June 13, 1978); see also Matter of: Lieutenant Colonel Carlo J. Montisano, AUS (Retired), B-196688 (1980 WL 17095) (Feb. 15, 1980).

In Matter of: Air Force Dental Officers, B-207109 (1982 WL 27593) (Nov. 29, 1982), the Comptroller General rejected various defenses of two Air Force Dental officers and found them indebted to the government for amounts paid to them by the Veterans Administration for dental services they rendered in a civilian capacity as part of their part-time private dental practice, while still on active duty. The Comptroller General cited the “established rule that in the absence of specific statutory authority, any agreement by an active duty member of the Armed Forces for the rendition of services to the Government in a civilian capacity is to be regarded as legally incompatible with the member’s military duties.” The Comptroller General also addressed the provisions of 5 U.S.C. §§ 5534 and 6323, which provide that a federal civil service employee may receive pay and allowances as a member of the Reserve in addition to civilian pay and 15 days annual military leave from the civil service job. The Comptroller General stated that the purpose of those provisions was to permit government employees to participate in the part-time Reserve program without a reduction in their civilian pay and vacation time. Sections 5534 and 6323 of 5 U.S.C. are not authority for an active-duty member of the uniformed services to obtain a civil service position or other civilian work compensated from appropriated funds. The Air Force officers were found indebted to the government because the public funds were erroneously paid to them; they had no right to the appropriated funds erroneously paid to them; and, thus, they were liable to make restitution of the full amount. B-207109 at 1-6; see also Matter of: Commander Martin

Page 18

P. Merrick, USN, and Petty Officer Albert Jackson, Jr., USN, B-204533 (1981 WL 22930) (Dec. 30, 1981) (employment of active-duty military personnel in federal civilian position related to high school extracurricular activities is incompatible with military duties and not compensable from appropriated funds).

In Matter of: Public Health Service Officer, B-214919, 64 Comp. Gen. 395 (1985 WL 50669) (Mar. 22, 1985), the Comptroller General reached the same result in the case of an active-duty Public Health Service (a uniformed service) commissioned officer who for 13 years, while on active duty, was also paid under a contract as a consultant to SSA. The Comptroller General stated that members of a uniformed service are entitled to pay based on their status not based on the performance of duties for certain number of hours. The Comptroller General continued that a member of the uniformed service is in status 24 hours per day, even if only performing duties for a number of hours during the duty day. The Comptroller General went further and stated that the facts of that case amounted to a violation of 5 U.S.C. § 5536, which provides:

An employee or a member of a uniformed service whose pay or allowance is fixed by statute or regulation may not receive additional pay or allowance for the disbursement of public money or for any other service or duty, unless specifically authorized by law and the appropriation therefor specifically states that it is for the additional pay or allowance.

64 Comp. Gen. at 399-400. The Comptroller General noted that it has been held that that statutory prohibition does not apply when there are two distinct offices, places, or employments, each with its own duties and compensation, and both of which could be held by one person at the same time. However, the Comptroller General stated that exception did not apply to a commissioned officer of a uniformed service because that status is incompatible with holding any other federal government position.

Congress has created two specific exceptions to the prohibition on receiving both civilian and military pay – 15 days of military leave authorized by 5 U.S.C. § 6323 and terminal leave authorized by 5 U.S.C. § 5534a.10 The entitlement of a member of a Reserve component to military leave is discussed above. Military leave permits the Reservist to receive regular pay and allowances and to continue to accrue leave in their federal civil service position even though absent from the civil service job performing military duty, including active duty, and receiving pay for that military service. The terminal leave

Page 19

provision of 5 U.S.C. 5534a, subject to the conditions specified, permits a member of the military on active duty to begin to work and receive pay in a federal civil service position paid by appropriated funds, even though the member continues to receive active duty pay and allowances. The statute provides:

A member of a uniformed service who has performed active service and who is on terminal leave pending separation from, or release from active duty in, that service under honorable conditions may accept a civilian office or position in the Government of the United States, its territories or possessions, or the government of the District of Columbia, and he is entitled to receive the pay of that office or position in addition to pay and allowances from the uniformed service for the unexpired portion of the terminal leave. Such a member also is entitled to accrue annual leave with pay in the manner specified in section 6303(a) of this title for a retired member of a uniformed service.

5 U.S.C. § 5534a; see also To Major G.B. Adams, B-165492 (1968 WL 2867) (Nov. 27, 1968).

The foregoing authorities clearly establish that a member of a uniformed service on active duty may not receive pay from appropriated funds for other federal government service, whether pursuant to a contract or from a federal civil service position, except in a military leave or terminal leave status or as otherwise authorized by law. Petitioner’s argument that she received approval to work “part-time for HHS while on flex-schedule telework orders as a National Guardsman” is without merit because no member of her military or civil service chain of command had authority to approve such an arrangement.11 RFH at 1; P. Br. at 1-2; P. Reply at 6-7.

Petitioner’s argument that she acted in good faith reliance on permission being granted by her National Guard and OMHA chains of command is also without merit. P. Reply at 1. The Comptroller General has rejected claims to retain erroneous payments from appropriated funds to a member of a uniformed service on active duty on theories such as quantum meruit or on equitable grounds, absent clear and convincing evidence that the indebted person acted in good faith. 64 Comp. Gen. 395, 404-06. I do not find that there

Page 20

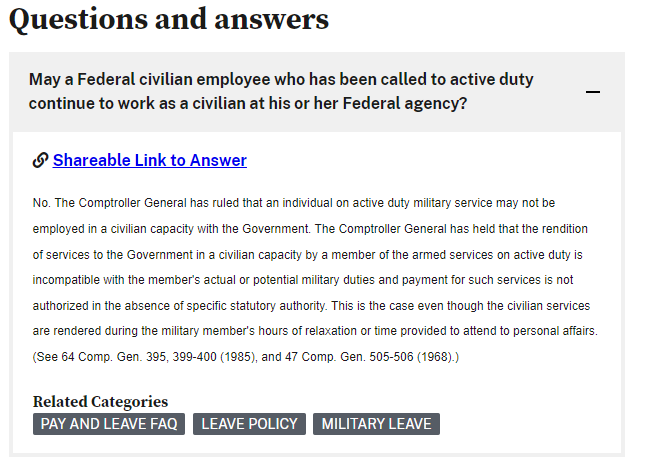

is clear and convincing evidence that Petitioner acted in good faith. Petitioner is a senior officer in the Judge Advocate General’s Corps and an ALJ. She asserts that she relied on permission or authorizations from her chain of command in the National Guard and OMHA. She does not allege that she did any legal research,12 research for which her positions indicate she was imminently qualified, to determine whether her work for both military pay and civil service pay was lawfully permitted. By simply checking the Office of Personnel Management website under pay and leave frequently asked questions, Petitioner would have learned that receipt of pay from both jobs is not permitted.13 Indeed, the following screenshot from the list of frequently asked questions specifically addresses the issue.

I conclude that Petitioner improperly received pay as an ALJ assigned to OMHA for periods when she was on active duty, including full-time National Guard duty, pursuant to military orders.

Petitioner argues that fraud occurred when her time and attendance records were changed by OMHA staff to place her in a LWOP status on dates she was on active duty. P. Reply at 6-7. I have no authority or jurisdiction to address that issue under 5 U.S.C. § 5514 or 45 C.F.R. pt. 33.

Page 21

Petitioner also argues that being placed in a non-pay status on days she was on active duty invalidates her acts as an ALJ, including decisions issued and hearings held on days she was in a non-pay status. P. Reply at 7. This issue is also not within my authority or jurisdiction to decide under 5 U.S.C. § 5514; 45 C.F.R. pt. 33.14

Debt Collection from Current Pay of Federal Employees

Debts owed to the United States from a federal employee may be collected from the current pay account of the employee, including basic pay, special pay, incentive pay, retired pay, retainer pay or other authorized pay, subject to the provisions of 5 U.S.C. § 5514. The amount that may be deducted is limited to 15 percent of disposable pay per pay period, unless the employee consents in writing to the collection of a larger amount. 5 U.S.C. § 5514(a)(1). Before an agency head may direct collection of indebtedness from the salary of an employee, due process must be provided. The employee must be given written notice a minimum of 30 days prior to any attempt to collect and the notice must inform the employee of the nature and amount of the debt determined to be due; the intention of the agency to effect collection through deduction from the employee’s pay; and the notice must explain the employee’s rights under 5 U.S.C. § 5514. The employee must be given the opportunity to inspect and copy government records related to the debt. The employee must be offered an opportunity to enter a written agreement agreeable to the agency head establishing a repayment schedule. The employee must also be given the opportunity for a hearing on the determination of the agency regarding the existence or the amount of the debt and any repayment schedule not established by written agreement. The statute requires that a hearing be provided only if requested within 15 days of receipt of the notice of indebtedness from the agency. The timely filing of a request for hearing automatically stays the commencement of collection proceedings. The statute requires that a decision be issued by the official designated to conduct the hearing not more than 60 days from the date of filing the request for hearing. The hearing may not be conducted by an individual subject to the supervision or control of the head of the agency, but the statute provides that it should not be construed to prohibit the appointment of an ALJ to conduct the hearing. 5 U.S.C. § 5514(a)(2). Collection of any amount pursuant to 5 U.S.C. § 5514 must be in accordance with standards promulgated pursuant to 31 U.S.C. §§ 3711 and 3716 through 3718. 5 U.S.C. § 5514(a)(4).

Page 22

Debt Collection from Current Pay of HHS Employees

The Secretary has promulgated the regulations at 45 C.F.R. pt. 3315 to effectuate the provisions of 5 U.S.C. § 5514 as required by 5 U.S.C. § 5514(b)(1). The regulations at 45 C.F.R. pt. 33 establish the standards and procedures for the collection of debts owed by a federal employee to the Unites States through involuntary salary offset. 45 C.F.R. § 33.1(a). The procedural process established by 45 C.F.R. pt. 33 is, for the most part, that prescribed by 5 U.S.C. § 5514. The regulations provide, with exceptions not applicable in this case, that the Secretary may involuntarily offset a debt owed to HHS against the employee’s disposable pay. 45 C.F.R. § 33.3(a). Before an offset may be effectuated, the Secretary must give the employee: written notice of the intent to offset, the opportunity to request a hearing, and a written determination by the hearing official with 60 days as to the existence and/or amount of the debt and the repayment schedule. 45 C.F.R. § 33.3(c). The notice of the intent to offset must be given at least 30 days before the offset is initiated and must give notice of several items specified by the regulation. 45 C.F.R. § 33.4(a). There is no allegation in this case the notice sent to Petitioner was insufficient.16 The hearing to be provided if timely requested by the employee will generally be on the written record, i.e., the documentary evidence and written argument of the parties. However, an oral hearing may be necessary if the hearing official, or in this case the ALJ, determines that the case cannot be resolved on the written record because there is an issue of credibility or veracity involved. Oral hearings are not adversarial and need not be conducted as an evidentiary hearing. 45 C.F.R. § 33.6(c). A written decision must be issued within 60 days after the date HHS received the request for hearing. 45 C.F.R. § 33.6(d).

All due process requirements have been met in this case.

Page 23

The Amount of Petitioner’s Debt

Petitioner challenges the existence of the debt. Petitioner did not challenge HHS’ calculation of the amount of the debt. My de novo review of the evidence shows that HHS correctly determined the net amount of Petitioner’s debt to be $13,307.47. OMHA Exs. 10 at 1-2, 15-18; 11 at 5.

No Repayment Schedule

There is no evidence before me that a repayment schedule was proposed. Accordingly, I conclude that there is no issue related to a repayment schedule to be resolved.

Petitioner has informed me that she has paid the debt. P. Br. at 3.

Waiver of Debt

Petitioner requests that if all her arguments are rejected and she is held liable for the debt, that HHS waive repayment. The regulations provided that:

This part [45 C.F.R. pt. 33] does not preclude an employee from requesting waiver of an erroneous payment under 5 U.S.C. 5584, 10 U.S.C. 2774, or 32 U.S.C. 716, or in any way questioning the amount or validity of a debt, in the manner prescribed by the Secretary. Similarly, this part does not preclude an employee from requesting waiver of the collection of a debt under any other applicable statutory authority.

45 C.F.R. § 33.1(c)(3). Waiver is defined as “the cancellation, remission, forgiveness, or non-recovery of a debt owed by an employee to this Department [HHS] or another agency as required or permitted by 5 U.S.C. 5584, 8346(b), 10 U.S.C. 2774, 32 U.S.C. 716, or any other law.”

Although the potential waiver of indebtedness is clearly recognized by the Secretary in 45 C.F.R. pt. 33, the Secretary has not delegated to me any authority to act on a waiver request.

Page 24

V. Conclusion

For the foregoing reasons, I conclude that Petitioner was indebted to the government in the amount of $13,307.47, plus any accrued interest, costs, and penalties. The debt would be subject to collection in any manner permitted by law, including administrative offset and administrative wage garnishment. However, Petitioner has informed me that the debt has been paid. P. Br. at 3.

Keith W. Sickendick Administrative Law Judge

- 1

Citations are to the 2021 revision of the Code of Federal Regulations (C.F.R.), which was in effect when Petitioner was notified of the overpayment.

- 2

Petitioner did not waive her right to review of the debt under 5 U.S.C. § 5514 or 45 C.F.R. pt. 33 by payment of the debt. 45 C.F.R. § 33.14.

- 3

The personal pronouns she and her are used in this decision as Petitioner has indicated no other preference.

- 4

Pursuant to 45 C.F.R. § 33.6, a petition for hearing (request for hearing) must be filed within 15 days of receipt of the notice of the existence or amount of the debt or the offset schedule established by HHS. Petitioner admits that she received the notice of the debt and the amount of the debt on August 30, 2022. Petitioner did not file her RFH until September 27, 2022, which is more than 15 days after the date she admitted she received the notice. However, both notices of the debt from DFAS advised Petitioner that she had 30 calendar days from the date of the notice to request a hearing. DAB E-File # 1 at 4, 6, 11 (document page counter). Therefore, I conclude that any objection by HHS to the timeliness of the RFH is waived.

- 5

HHS marked its exhibits “OMHA Ex.” Petitioner, an ALJ, was assigned to OMHA in Phoenix, Arizona. OMHA is part of HHS within the Office of the Secretary of HHS. OMHA Ex. 11 at 1; https://www.hhs.gov/about/agencies/orgchart/index.html (last visited Nov. 9, 2022).

- 6

32 U.S.C. § 502(a) provides:

(a) Under regulations to be prescribed by the Secretary of the Army or the Secretary of the Air Force, as the case may be, each company, battery, squadron, and detachment of the National Guard, unless excused by the Secretary concerned, shall—

(1) assemble for drill and instruction, including indoor target practice, at least 48 times each year; and

(2) participate in training at encampments, maneuvers, outdoor target practice, or other exercises, at least 15 days each year.

However, no member of such unit who has served on active duty for one year or longer shall be required to participate in such training if the first day of such training period falls during the last one hundred and twenty days of his required membership in the National Guard.

- 7

10 U.S.C. § 12301(d) provides:

At any time, an authority designated by the Secretary concerned may order a member of a reserve component under his jurisdiction to active duty, or retain him on active duty, with the consent of that member. However, a member of the Army National Guard of the United States or the Air National Guard of the United States may not be ordered to active duty under this subsection without the consent of the governor or other appropriate authority of the State concerned.

- 8

An “officer” in the civil service is a justice or judge of the United States or an individual who is required by law to be appointed to the civil service by the President, a court of the United States, the head of an Executive agency, or the Secretary of a military department; who is engaged in the performance of a federal function under authority of federal law or an Executive act; and who is subject to supervision by their appointing authority or the Judicial Conference of the United States, while performing the duties of their office. 5 U.S.C. § 2104(a); see also, Lucia v. SEC, 585 U.S. ___, 138 S.Ct. 2044 (2018) (United States Securities and Exchange Commission ALJs are officers of the United States). The meaning of the term “officer” in the civil service is different than the meaning of “officer” as used in the context of the uniformed services.

- 9

The Comptroller General is required by Congress to settle all accounts of the United States and supervise the recovery of all debts certified to the Comptroller General as due to the United States. 31 U.S.C. § 3526. The Comptroller General’s settlement of an account of the United States is binding on the executive branch. 31 U.S.C. § 3526(a), (d). The Comptroller General is head of GAO (formerly the General Accounting Office, currently the Government Accountability Office). 31 U.S.C. § 702. Until 1996, the Comptroller General shared responsibility with the Attorney General for debt collection. Comptroller General opinions regarding debt collection continue to be considered authoritative. Effective December 18, 1996, the Comptroller General’s authority to collect and to prescribe standards for and to waive claims against government employees and members of the uniformed services for erroneous payments of pay and allowances, travel, transportation, and relocation expenses was transferred to the Director of the Office of Management and Budget (OMB) for government employees, other than legislative branch employees, and members of the uniformed services. General Accounting Act of 1996, Pub. L. 104-316, 110 Stat. 3826, 3834-35. OMB redelegated the authority to the head of the agency that made the erroneous payment. See, e.g., OMB Circular No. A-129 (Rev. Nov. 2000).

- 10

Reserve and National Guard differential pay under 5 U.S.C. § 5538 is not at issue in this case.

- 11

Arguably, even the Secretary of HHS has no authority to approve Petitioner’s receipt of her civil service pay while she was serving on active duty as she was in this case, because approval would be in contravention of the incompatibility doctrine.

- 12

There is evidence that Petitioner did do some research as she instructed OMHA staff by email on May 2, 2022, regarding the OPM’s direction to use an SF 50 to report LWOP-US. OMHA Ex. 4 at 5.

- 13

Https://www.opm.gov/frequently-asked-questions/pay-and-leave-faq/?page=undefined (last visited Nov. 9, 2022).

- 14

Petitioner cites no authority in support of her theory. Petitioner also does not explain why, assuming she was properly appointed an ALJ and continued to be employed as such, that the validity of her actions as an ALJ were adversely affected by her not being entitled to receive her pay as an ALJ on the days she was on active duty.

- 15

Information provided with the request for hearing indicates that HHS debt collection in this case was to be by salary offset of an employee. Therefore, the regulations applicable are those at 45 C.F.R. pt. 33, rather than the general administrative wage garnishment procedures at 45 C.F.R. pt. 32, tax refund offset under 45 C.F.R. pt. 31, or the general claims collection provisions of 45 C.F.R. pt. 30.

- 16

Petitioner did not receive the debt worksheets referred to by the DFAS notice letters as being attached. P. Br. at 1. However, HHS filed the worksheets marked as OMHA Ex. 10 and Petitioner was granted an opportunity to respond to the HHS filing, curing any defect in the notice of debt.